Table of Contents

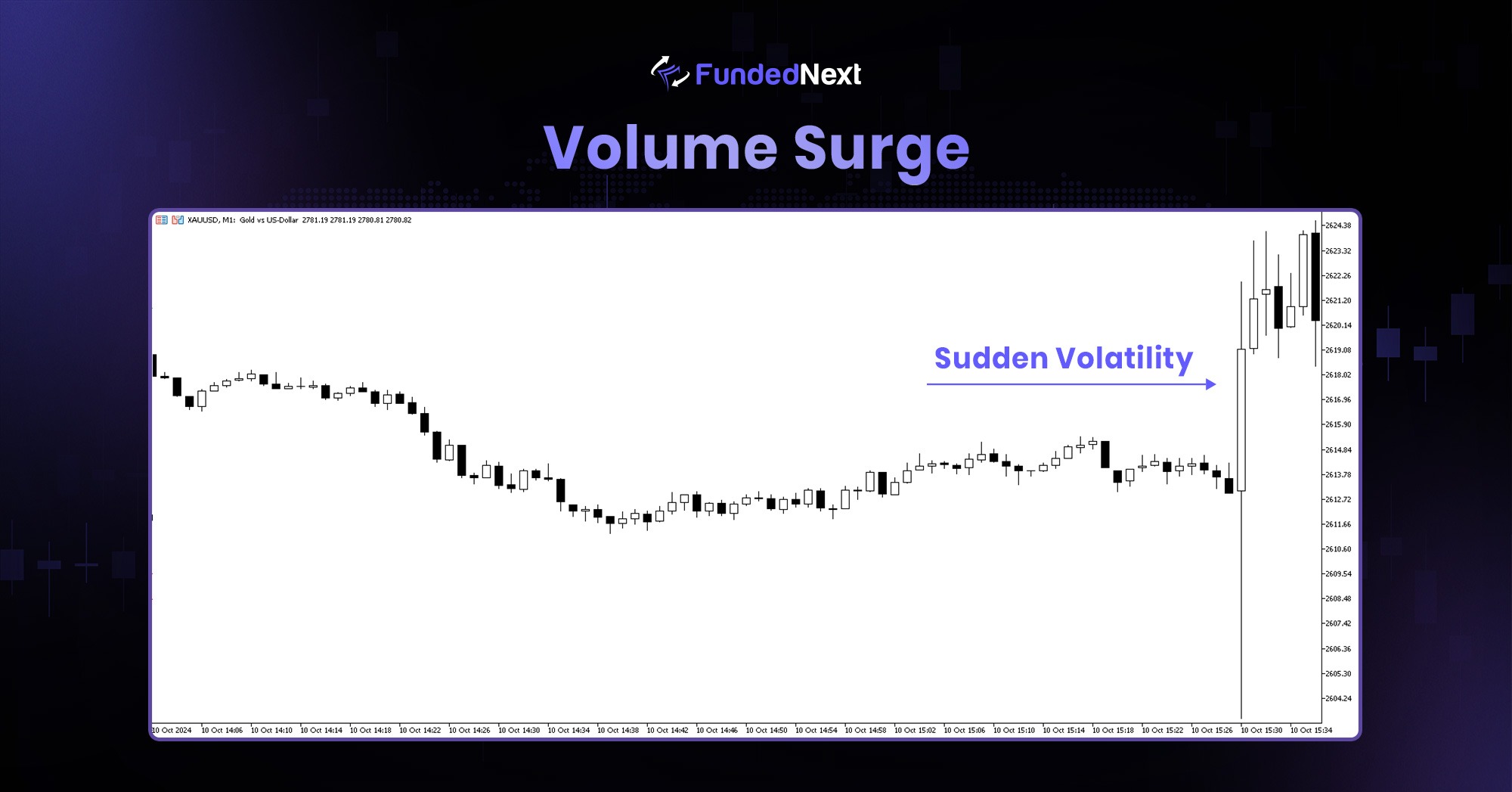

Volume surge is one of the most common phenomena in forex trading that indicates significant market activity. A Volume Surge is incurred when there is an abrupt and large increase in the trading volume of a particular asset, such as “Forex pairs, Commodities, Indices & Crypto” or any specific symbol over a short time period.

What Is a Volume Surge?

A volume surge refers to a sharp increase in the number of trades being executed for a specific financial instrument. Volume represents the total number of shares, contracts, or units traded during a certain time frame, such as a minute, hour, or day. When the candle suddenly surges, it often indicates that something significant is happening in the market that is attracting attention and influencing traders’ behavior.

For example, if a symbol that typically traded 1 million volume per day and suddenly goes at 5 million volume within a short time, this would be considered a volume surge. This can be caused by news events, changes in market sentiment, or large institutional trades.

When the market moves with this kind of sudden liquidity injection, prices do not move sequentially like 1, 2, 3, 4, 5, 6, 7; instead, they rapidly jump from 1 to 10-20, creating gaps in the market.

Thus, when you place an order request in the market at – let’s say ‘x’ the price may have already moved down/up to ‘y’.

Causes of a Volume Surge

There are several reasons a volume surge can occur:

- Economic News Releases: Major economic announcements, such as interest rate decisions, employment reports (e.g., Non-Farm Payroll), or inflation data, can cause significant volatility in the forex market, leading to volume surges. Traders often react to these news releases by opening or closing positions based on how they believe the market will move.

- Market Sentiment Shifts: A sudden change in market sentiment, either positive or negative, can lead to an influx of trades. For example, if investors believe that a currency is going to strengthen due to favorable economic data, they may rush to buy it, leading to a surge in trading volume.

- Monetary policy: Monetary policy, especially changes in interest rates, is one of the major reasons behind volume surge in trading. When central banks like the Federal Reserve or the European Central Bank announce interest rate changes, it impacts the value of currencies and other assets. Traders respond quickly to these announcements, buying or selling assets based on the expected impact, which leads to a surge in trading volume as everyone adjusts their positions.

- Fundamental Reason: Fundamental events like wars or geopolitical conflicts often lead to volume surges in trading as they create uncertainty and impact global economies. When a conflict arises, investors and traders quickly respond by adjusting their positions, which can lead to a sudden increase in trading activity.

Risks Associated with Volume Surges

During periods of high volatility, such as news releases or geopolitical events, sudden volume surges can result in slippage, wide spreads, or infrequent price movements. Traders should use caution during these times and consider employing risk management strategies, such as stop-loss orders, to protect their capital.

Additionally, not all volume surges indicate a trend continuation. In some cases, a volume surge may signal a temporary market imbalance.

Several Factors May Incurred During a Surge

- Bad Market Order Fills

- SL/TP might not fill at expected price

- Pending order may not get executed due to internal price gap

Conclusion

A volume surge is a natural phenomenon in the financial markets, often triggered by fundamental events, economic news, or shifts in monetary policy. While volume surges can offer valuable trading opportunities by signaling strong market sentiment, they can also disrupt normal trading in various ways. During these high-activity periods, traders may face challenges such as slippage, widened spreads, and delayed or rejected orders, all of which can affect trade execution and lead to unexpected outcomes.